[ad_1]

That is half 2 of Jeff Goldsmith’s historical past of managed care. In case you missed it learn Part 1

By JEFF GOLDSMITH

The late Nineteen Nineties crash of HMOs opened the door to a serious consolidation of the medical insurance market managed largely by nationwide and super-regional well being plans. Whereas HMOs not at all disappeared post-backlash, the “motion” begun by Ellwood and Nixon fell far in need of nationwide attain. HMOs by no means established a significant presence in essentially the most quickly rising elements of the US- the Southwest, South and Mid-Atlantic areas, in addition to the Northeast.

The exemplar, Kaiser Permanente, broken its monetary place with an ill-considered 1990’s (McKinsey-inspired) push to turn into a “nationwide model”. At this time, over 80% of Kaiser’s 13 million enrollment remains to be within the West Coast markets the place it started 80 years in the past!

HMOs Go Public and Roll Up

Two little seen developments accelerated the shift in energy from suppliers to payers. One was the motion of supplier sponsored well being plans into the general public markets. PacifiCare, essentially the most vital hospital sponsored well being plan owned by the Lutheran Hospital Society of Southern California, was taken public in 1995. A subsequent merger with FHP health plan destabilized the newly public firm.

After PacifiCare crashed put up the 1998 Balanced Funds Act cuts, and struggled to refinance its debt, it was acquired by United Healthcare in 2005, bringing with it an enormous subtle, delegated danger contracting community. United then bought Sierra Health Plan primarily based in Nevada in 2007, together with its giant captive medical group, its first medical group acquisition. Following these acquisitions, United rolled up PacifiCare’s southern California primarily based at-risk doctor teams within the late 00’s, after which capped off with its purchase of HealthCare Partners, the most important of all, 2017 from DaVita in forming the spine of in the present day’s $110 billion Optum Well being.

United’s shopping for BOTH sides of the delegated danger networks-plan and docs-in excessive penetration managed care markets will not be totally appreciated by most analysts even in the present day.

It has meant that as a lot as 40% of Optum Well being’s revenues, together with virtually $24 billion in capitated medical insurance premiums, come from opponents of United’s medical insurance enterprise.

Nevertheless, of higher strategic significance was Humana’s choice in 1993 to exit the hospital business by spinning its 90 hospitals off as Galen.

Humana’s unsentimental founders, David Jones and Wendell Cherry, concluded that the extraordinary doctor push again in opposition to their rising well being plan meant that their two enterprise had been basically incompatible, and so they selected to retain possession of the upper margin and fewer advanced enterprise.

Galen hospitals started a prolonged and unhappy journey by means of a number of owners-Rick Scott’s ill-starred Columbia/HCA, Tenet, after which a number of others. At this time, Humana is the second largest “participant” within the Medicare Benefit market, and had a market cap north of $60 billion (till a month or so in the past).

HIPAA Units Stage for twenty-four/7 Digital Surveillance of Medical Determination Making

The opposite little remarked improvement supplied the technical basis for a payer managed care system- the Well being Insurance coverage Portability and Accountability Act of 1996 (HIPAA). Up till the mid-Nineteen Nineties, healthcare claims had been paper and fax transmitted, expensive and unreliable. Although HIPAA is especially recognized for its confidentiality protections for affected person information, its Administrative Simplification provisions set information requirements to encourage digital submittal and cost of medical claims.

HIPAA inspired the emergence of digital information interchange by means of devoted T-1 traces, hardwired ancestors of in the present day’s VPNs–excessive capability, safe bodily hyperlinks between hospitals and their main payers. HIPAA markedly accelerated the usage of digital information interchange (EDI) in healthcare, to the good benefit of well being insurers.

HIPAA spawned an entire ecosystem of small firms who served as monetary intermediaries between well being insurers and care suppliers–aggregating, transmitting and processing medical claims and paying suppliers for his or her care. These firms proliferated in the course of the first Web funding bubble, which started after Netscape’s historic IPO in 1995. When the Web bubble burst in 2000, these firms had been offered by their non-public fairness and enterprise house owners in an ensuing multi-year fireplace sale.

PPO Development Burns Down the Business Price Construction

Whereas the HMO motion faltered, provider-centric delegated-risk capitation gave method to broad panel “most well-liked supplier group” (PPO) managed care which paid physicians and hospitals a reduced fee-for-service, and overlaid exterior utilization controls like prior authorization. The PPO motion markedly diluted doctor financial energy. PPOs had been principally an industrialized model of conventional Blue Cross, solely with out doctor or hospital governance enter.

PPO well being plans threatened to exclude native suppliers that didn’t grant them vital reductions. Impartial physicians had zero leverage on this transaction. Hospitals who discounted their charges within the panic to keep away from being excluded found that their pricing concessions yielded no development in quantity or market share, simply diminished revenues. This late Nineteen Nineties pricing panic burned down hospital business price buildings within the West and Southwest, as far east as Chicago, Minneapolis and St. Louis, and accelerated the development to system consolidation.

The ObamaCare Pageant of Technocratic Enthusiasm

On the similar time, Medicare moved aggressively to get suppliers into a brand new, much less politically inflammatory model of managed care for big common Medicare market (e.g. the non-Medicare Benefit portion). The 2010 Inexpensive Care Act’s predominant occasion was to develop well being protection to the working poor by means of a partial nationalization of the person insurance coverage market and an aggressive enlargement of Medicaid. This protection enlargement was an enormous success, bringing new protection to 30 million People.

However in a muted afterthought, recognizing persevering with well being value strain, ObamaCare additionally sought to revive, for one final time, for normal Medicare, the Ellwood/Enthoven imaginative and prescient of a remodeled, at-risk care system. Having concluded that the closed panel, capitated built-in care system mannequin couldn’t be reached in a single unimaginable transformation, because the Clintons tried and didn’t do, it will sow the seeds of capitation by means of a “managed care” lite mannequin referred to as Accountable Care Organizations.

There have been two ACO concessions to the post-HMO backlash atmosphere. First, Medicare sufferers weren’t compelled into managed care plans (and even informed they had been in them), and suppliers could be insulated from draw back monetary danger for a prolonged interval. ACO membership was a statistical assemble, not a consensual affected person panel; sufferers could be assigned to ACOs if their major care physicians participated. The shortage of affected person selection violated a key precept of the Ellwood/Enthoven mannequin, by which sufferers would select techniques of care and reap a monetary reward for making the “proper selection”.

The second was that suppliers would proceed to be paid Medicare’s charge for service however a shadow accounting system would observe ACO spending. If ACO spending fell under development in regional Medicare spending, suppliers would get a bonus. They might even be required to trace dozens of “high quality” measures and get a small bonus in the event that they exceeded norms. The late Uwe Reinhardt pricelessly characterised “worth primarily based cost” as “fee-for-check-the-box. . . for ideas” . ACOs unfolded as managed care with out the danger, coaching wheels for a later shift to capitation.

Massive business well being plans serving employers shadowed the Medicare ACO program, making the most of yet one more hospital pricing panic primarily based on deeply discounted charges. Most of the plans provided beneath ObamaCare’s insurance coverage exchanges had been of this kind. Whereas it was assumed by suppliers that business ACOs would transfer quickly towards true delegation of danger, a decade on, the danger mysteriously has not handed over to suppliers, who’ve spent not less than $10 billion getting ready for ACOs. Doctor time in serving to handle ACOs and in minutely documenting all these “core measures” is invariably costed at “zero”.

If one counts the bonuses paid out to profitable ACOs, the fee overruns by the ACOs that missed their value targets on the excessive aspect, and the fee to Medicare of establishing, administering and monitoring them, this system has but to succeed in breakeven. Paid out bonuses tended to be extremely concentrated in these lucky ACOs working in excessive Medicare value markets. To nobody’s shock, physician-sponsored ACOs (facilitated by a profitable business of organizers and contracting consultants) have decisively outperformed these sponsored by hospitals.

At this time, maybe 14 million regular Medicare beneficiaries are in some type of ACO, largely with out their very own information. MedPac has characterised Medicare’s ACO program as a “disappointment” and a latest NEJM article by a former head of the Middle for Medicare and Medicaid Innovation (CMMI) discovered that solely 5 of the 59 cost experiments by the company had truly saved Medicare cash. If the ACO was meant as a bridge to a “a number of Kaisers in regional markets” well being system, it is a bridge to nowhere.

Nevertheless, as an “business”, the ACO motion has been an unimaginable success. The post-ACA push to ACOs created one of the vital profitable consulting franchises within the final forty years. Wags mentioned ACO stood for “Awesome Consulting Opportunity”. And personal fairness facilitators of ACO participation corresponding to Evolent, Aledade, Agilon and Privia have unicorn degree market caps and are being shopped by non-public fairness house owners and bankers to would-be healthcare disrupters. To echo a Wall Road wag, one wonders the place are the sufferers’ and physicians’ yachts.

All of the whereas, the untransformed common Medicare program has been eclipsed by Medicare Advantage, which employed non-public well being plans to arrange and handle Medicare providers for, what’s in the present day, nicely greater than half of Medicare’s 66 million beneficiaries. This program has been captured by a handful of enormous business insurers, two of whom–Humana and United Healthcare–management virtually half of MA’s 33 million beneficiaries, and is by far their most worthwhile line of enterprise.

Precise Capitated Danger for Suppliers has been in Scarce Provide

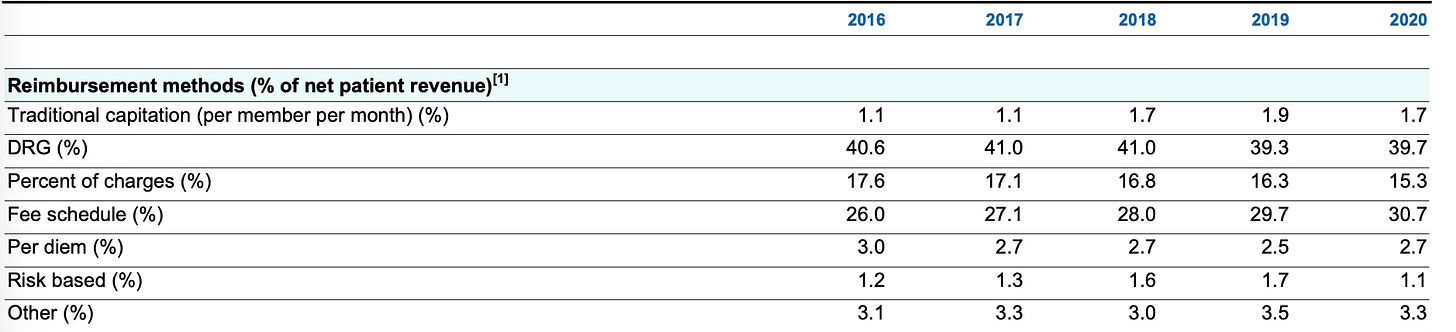

Nevertheless, these giant business carriers have been disinclined to share their danger (and income) with care suppliers. Moody’s Investor Service discovered that the median US hospital obtained only one.7% of their revenues from capitation, and one other 1.1% from “two-sided” ACO type danger in 2020, up from 1.1% and 1.2% respectively in 2016.

Hospital Income Sources: Median Values

Supply: Moody’s Investor Service, 2021

By 2013, capitation as a proportion of major care workplace primarily based revenue had fallen to solely 5% from 15% mid the earlier decade, in line with HHS analysts. Present two sided danger revenue for physicians is unknown to this analyst, however is believed to be negligible.

Keep tuned for Half III of this Managed Care Historical past the place we give attention to the transformation of managed care right into a machine and algorithm pushed surveillance system for physicians and hospitals.

Jeff Goldsmith is a veteran well being care futurist, President of Well being Futures Inc and common THCB Contributor. This comes from his personal substack

[ad_2]

Source link